In Switzerland, VAT rates will be increased as of 01.01.2024. We offer you a comprehensive summary of the publication by the Federal Tax Administration (FTA) and present detailed steps as well as further recommended measures.

1. VAT rate increase as of 01/01/2024

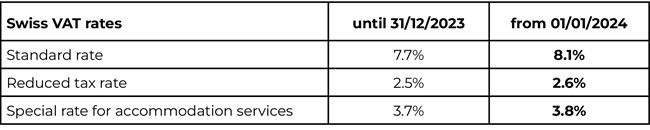

In Switzerland, the VAT rates will be increased as of 01/01/2024 as follows:

The increase is based on the referendum of 25/09/2022 and serves to finance OASI (old-age and survivors insurance in Switzerland).

2. Specific procedure, application of the new VAT rates

The FTA (Swiss Federal Tax Administration) published its publication on implementing tax rates titled ‘VAT Info 19 (MI 19), tax rate increase as of 1 January 2024’, on 07/02/2023. It has issued the following Principles and Instructions for Implementation. The full publication can be viewed via the following link: MWST-Info 19 Steuersatzerhöhung per 1. Januar 2024. This publication is legally binding. We have summarised the key points as follows. We have concluded that the current principles correspond to those of the previous VAT rate changes, in particular those of 01/01/2018.

Implementation principles and instructions:

- The applicable VAT rate is determined by the time at which a service is performed. In other words, the date of invoicing, payment or posting are not decisive. In the case of periodic services (e.g. subscriptions), the period in which services are performed is decisive. Services rendered up to 31/12/2023 are subject to the previous VAT rates. Services rendered from 01/01/2024 are subject to the new VAT rates. If services that are subject to both the previous and the new VAT rates due to the period in which they are provided are listed on the same invoice, the date or period when services are performed and the respective share of the amount attributable to them must be shown separately. If this is not the case, all invoiced services must be invoiced using the new VAT rates. This also applies to services that are subject to acquisition tax.

- Partial payments and partial invoices: Partial payments for services rendered up to 31/12/2023 must be invoiced at the previous VAT rates and settled with the FTA. Partial payments for services rendered on or after 01/01/2024 must be invoiced at the new VAT rates and settled with the FTA. The FTA recommends that contracts that have not yet been completed must be correctly delimited by the end of 2023 in partial invoices and situational budgets (e.g. in the construction industry). In the case of construction services, the point at which services are performed is deemed to be when work is carried out on the structure (e.g. assembly, relocation or stabilisation). Prefabrication work in a workshop is not classified as work carried out on a building.

- Prepayments and prepayment invoices: If it is known at the time of the prepayment or prepayment invoice that the delivery or service will take place in its entirety or in part after 31/12/2023, the part of the service attributable to the period from 01/01/2024 should be entered at the new VAT rate both in the invoice to customers and in the settlement with the FTA.

- Periodic payments: Rental and leasing contracts, subscriptions or service and maintenance contracts, for items such as lifts, household machinery, computer systems and the like, must generally be paid in advance. If such a subscription or contract extends beyond the date of the tax rate increase (01/01/2024), the fee must be divided pro rata temporis between the existing and new VAT rates.

- Remuneration reductions (discounts, rebates, complaints of defects or losses) for services from the period prior to 01/01/2024 must be corrected using the current VAT rate.

- Returns of items and cancellation of services must be treated as reductions in charges at the VAT rates applicable at the time (or period) the services are performed.

- Importation of goods: The new VAT rates apply to all imports of goods for which the import tax liability is incurred on or after 01/01/2024.

- Input tax deduction: In principle, the domestic tax invoiced may be claimed as part of the company’s business activities. If the service provider invoices the tax difference with reference to the original invoice with the incorrect VAT rate, the service recipient may deduct input VAT for this purpose.

- VAT accounting, practical procedure: In the Q3 2023 VAT statement, sales can be declared for the first time at both the current and the new VAT rates

- Balance tax rates: These will also be adjusted. The same applies to the limits (turnover limit and tax payment burden) for applying this settlement method. The current change in the VAT rate does not entitle the holder to make an extraordinary switch from or to this method; the general deadlines for this apply.

3. Further recommendations:

- Implement the new VAT rates in your accounting and billing systems in good time. Please also note VAT codes, accounts, etc.

- Companies that provide multi-year services and are billing for them in 2023 should adjust their invoicing process accordingly in good time.

- Check contracts and other VAT-relevant documents in good time (e.g. price lists, cash receipts from cash registers, etc.) and adjust them accordingly if necessary.

- Inform and train all those involved in good time, e.g. teams in accounting/finance, sales, purchasing, etc.

- For quotations and contracts, we recommend using general wording such as “plus the applicable statutory VAT.” The upcoming VAT rate change will not be the last. However, we would like to point out that this is not permissible for invoices and is not sufficient for input tax deduction. In these cases, the respective VAT rate must be entered specifically as a percentage; for example, net amount plus 8.1% VAT, gross amount; or “invoice amount including 8.1% VAT.”

Please do not hesitate to contact us if you have any further questions or require adjustments, reviews of VAT codes, etc.

Your Contact

Back to overview

Back to overview